Download and Print an IFTA Fuel Report

IFTA is an important part of fleet compliance in addition to the ELD mandate and Hours of Service (HOS) management. The International Fuel Tax Agreement (IFTA) is a fuel tax paid by commercial carriers to fund highway maintenance in 48 U.S. states and 10 Canadian provinces. Transflo Telematics can significantly help with IFTA compliance and reporting by tracking miles and fuel use.

-

Under the IFTA agreement, qualified motor carriers can obtain an IFTA license for their motor vehicles allowing them to travel through other IFTA jurisdictions and submit only one quarterly fuel tax return in their base jurisdiction for fuel usage.

-

If motor carriers are not registered with IFTA The International Fuel Tax Agreement (IFTA) is a fuel tax paid by interstate commercial carriers to fund U.S. and Canada highway maintenance in 48 American jurisdictions (states) and 10 Canadian jurisdictions (provinces) that are currently members of IFTA. Transflo telematics can significantly help with IFTA compliance and reporting by tracking miles and fuel use., they must comply with the fuel tax reporting guidelines of each individual jurisdiction in which they travel, which may include purchasing fuel trip permits.

To view an IFTA report for one or more vehicles and time periods and save it as PDF, Excel spreadsheet, or print it on paper, follow these steps:

-

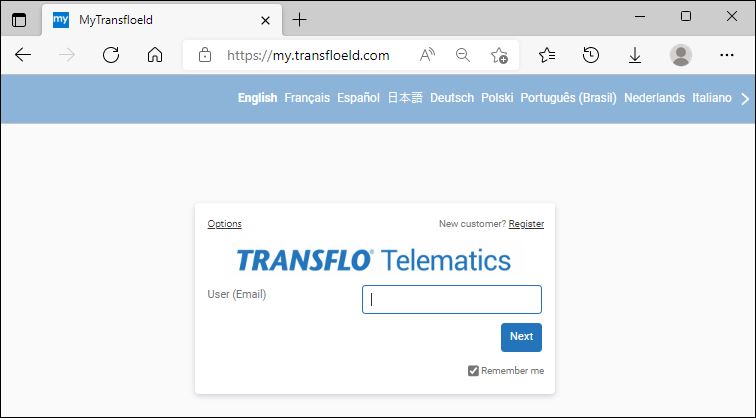

Log in to your ELD web portal at https://my.transfloeld.com.

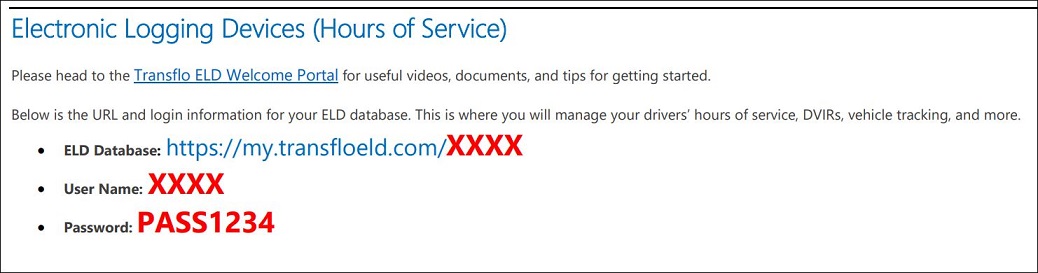

Tip: You or your administrator received a welcome e-mail (as shown below) with the exact ELD database URL and credentials for your company or fleet account. You may have received a similar e-mail from your administrator. Use the same e-mail and password you used when you registered. If you changed a username (e-mail) or password, use the new ones.

-

Select your preferred language and enter the same credentials you use to log in to the Transflo mobile app or HOS app. Click or tap Log in.

-

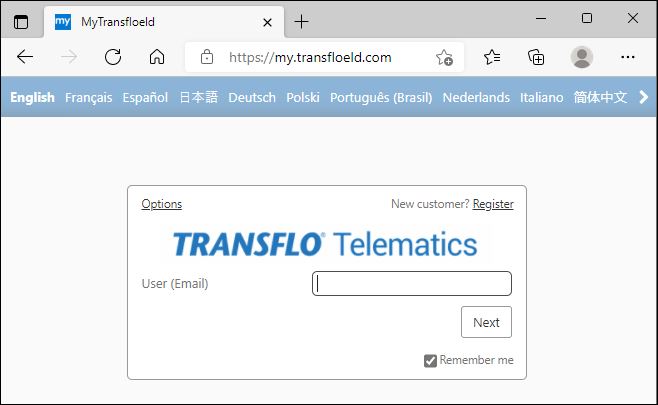

Expand the Activity menu item and choose IFTA Report.

-

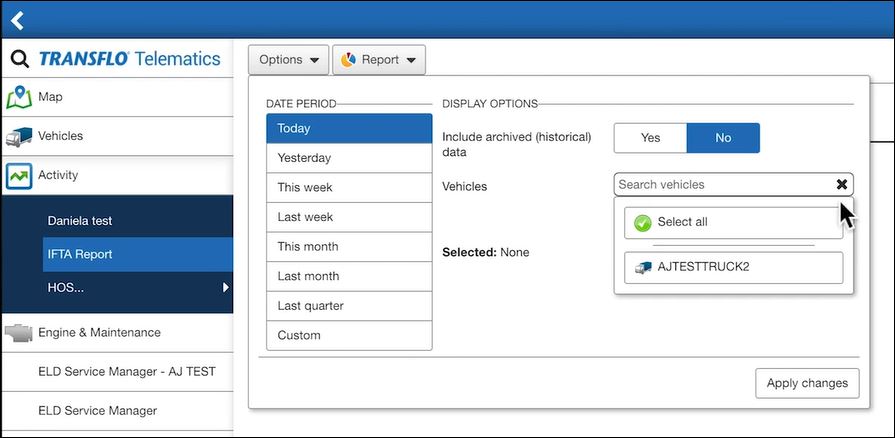

In the Vehicles field, search and select one or more vehicles to have their mileage measured and included in the report.

-

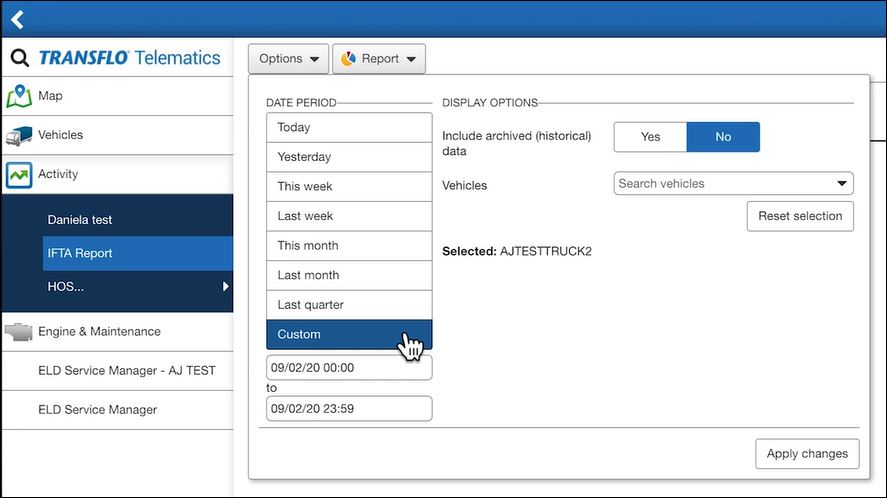

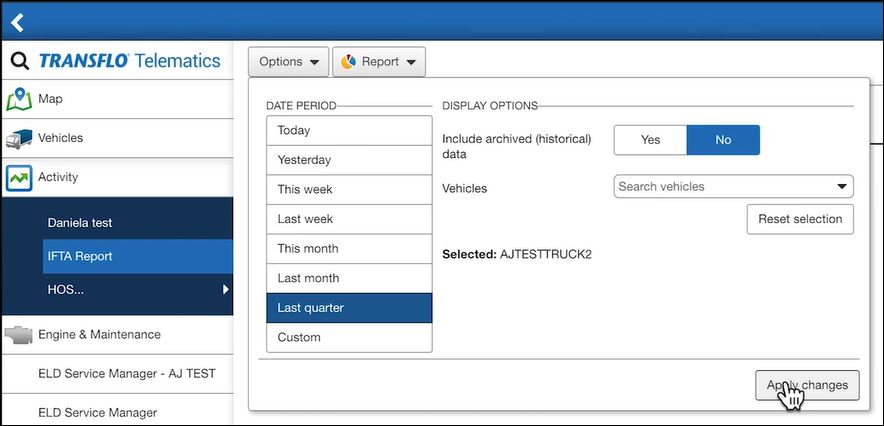

Select a DATE PERIOD, for example, today or last quarter. The Custom option allows you to define a Starting Date and an Ending Date for your own custom date range for the report.

-

Click Apply Changes.

-

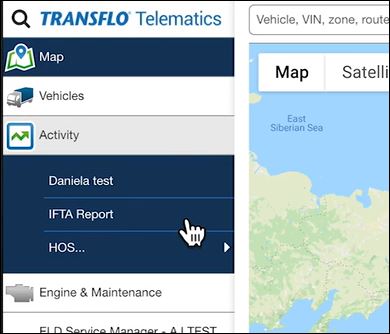

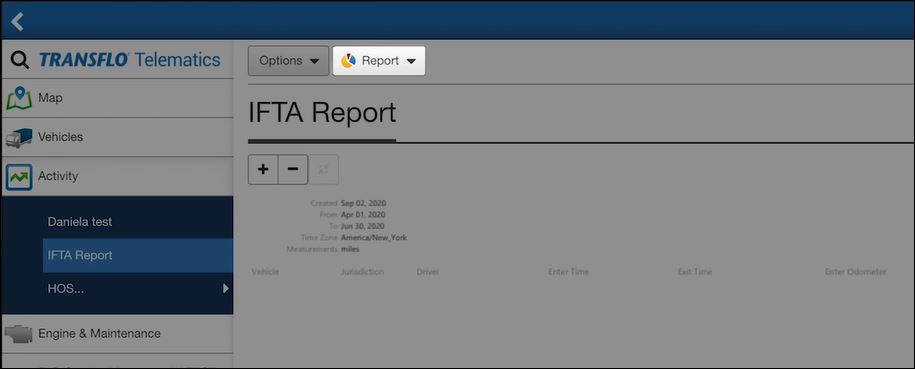

The Transflo Telematics web portal generates your IFTA report. The miles are sorted by Jurisdiction (state or province) with the time frame of the trip. The top section shows each jurisdiction in chronological order. The next section shows the miles separated by jurisdiction and includes a breakdown of the total miles.

Note: If you are looking up a large time frame, the IFTA report shown is only a preview, and you will need to download it to see the full report.

-

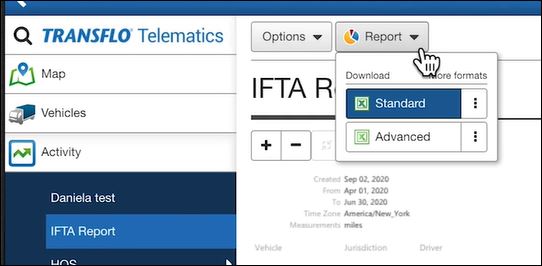

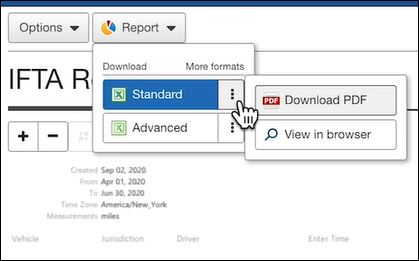

To download the report, tap the Report button.

-

(Optional) To print this report to paper and ink, use the PDF and Excel buttons at the top and another application such as Microsoft Excel or Adobe Acrobat Reader and your local or network printer.

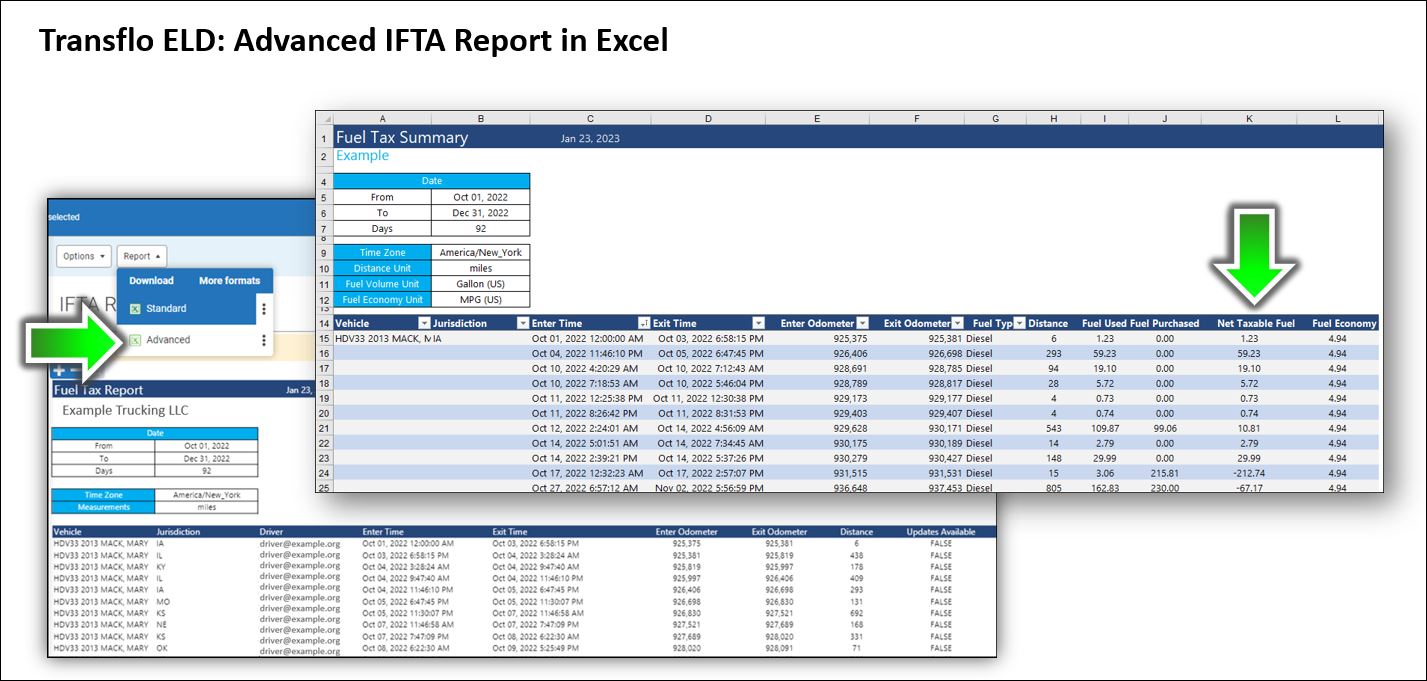

Example:

The following image shows an advanced IFTA report you can open in Microsoft Excel for completing DOT fuel usage forms by state. The report shows Net Taxable Fuel entries and totals by state for fuel usage reporting to the DOT.

![]() View a demonstration of these steps in one or more Transflo videos:

View a demonstration of these steps in one or more Transflo videos: